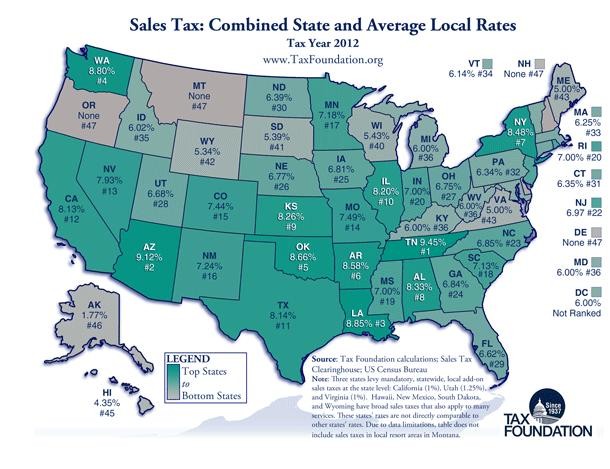

Birmingham also has the highest local option sales tax rate among major cities, at 6 percent, with Denver, Colorado (5.91 percent), Baton Rouge, Louisiana (5.50 percent), and St. Louis, Missouri (5.454 percent) close behind. Both Baton Rouge and New Orleans, Louisiana previously had combined rates of 10 percent, but these cities’ rates

34 Compelling Compare and Contrast Essay Examples

• The five states with the highest average combined state and local sales tax rates are Tennessee (9.55 percent), Louisiana (9.52 percent), Arkansas (9.51 percent), Washington (9.23 percent), and Alabama (9.22 percent). • No state rates have changed since Utah increased the state-collected share of

Source Image: pbn.com

Download Image

Delaware, Montana, New Hampshire and Oregon rank lowest with no state or local sales taxes. Alaska comes next with a combined local and state rate of 1.61 percent, followed by Hawaii (4.38 percent), Maine (5 percent), Virginia (5 percent), Wisconsin (5.42 percent) and Wyoming (5.42 percent). The states with highest combined state–local rates

Source Image: taxfoundation.org

Download Image

Massachusetts Tax Rates & Rankings | Massachusetts Taxes The base state sales tax rate in Massachusetts is 6.25%. Local tax rates in Massachusetts range from 6.25%, making the sales tax range in Massachusetts 6.25%. Find your Massachusetts combined state and local tax rate. Massachusetts sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax

Source Image: redfin.com

Download Image

Combined State And Local Sales Tax Rate Of Boston

The base state sales tax rate in Massachusetts is 6.25%. Local tax rates in Massachusetts range from 6.25%, making the sales tax range in Massachusetts 6.25%. Find your Massachusetts combined state and local tax rate. Massachusetts sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax The latest sales tax rate for Boston, MA. This rate includes any state, county, city, and local sales taxes. 2020 rates included for use while preparing your income tax deduction. MA Rates | Calculator | Table. Boston … Rate; Massachusetts State: 6.250%: Suffolk County: 0.000%: Boston: 0.000%: Total:

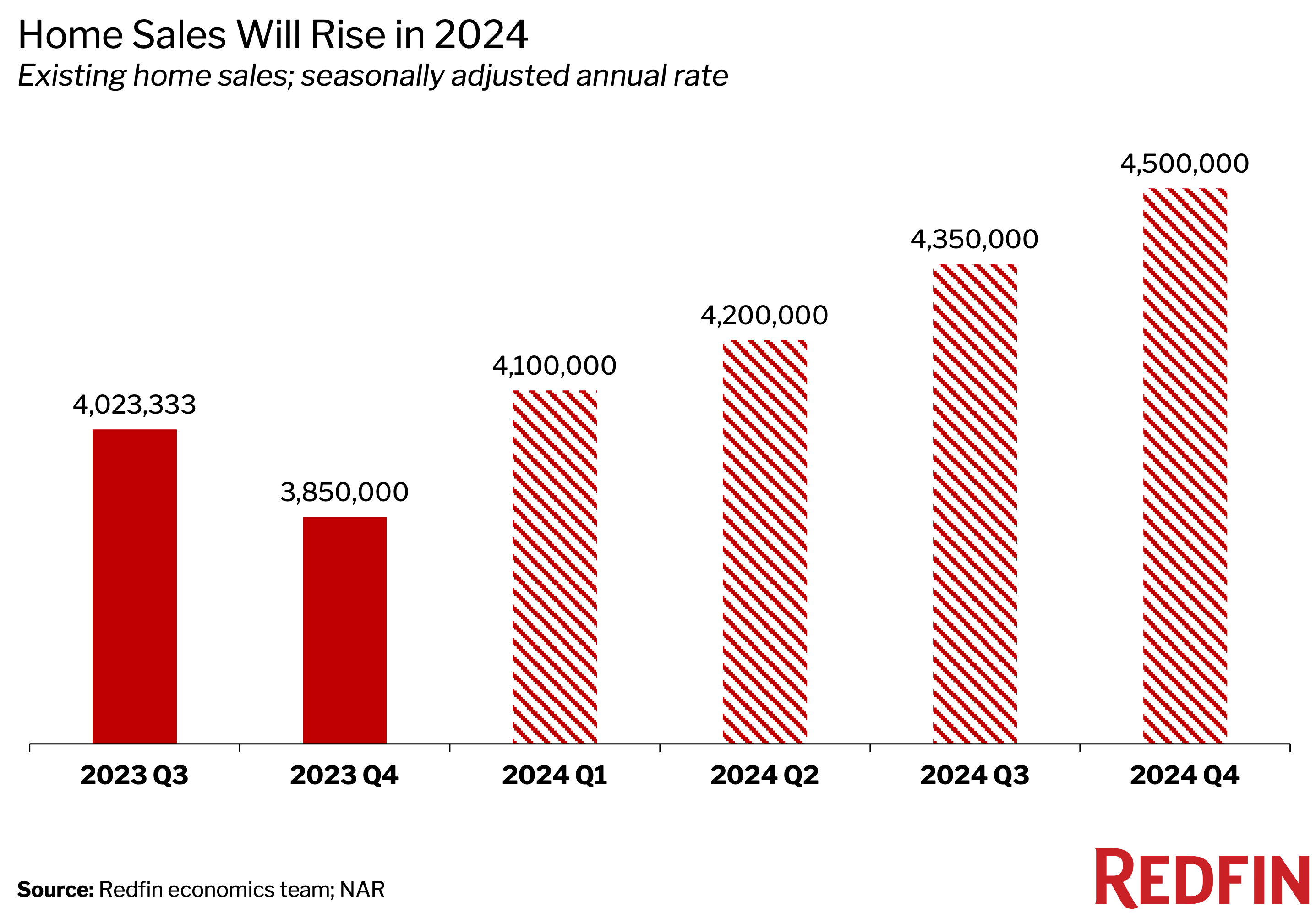

Redfin Predicts 2024 Will Be the Year Homebuyers Catch a Break, With Home Prices Falling and New Listings Rising

Feb 6, 2024rates are Louisiana (9.56 percent), Tennessee (9.55 percent), Arkansas (9.45 percent), Washington (9.38 percent), and Alabama (9.29 percent). Local sales tax. A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and Our communities are eroding:’ Towns urge transfer fee passage – The Martha’s Vineyard Times

Source Image: mvtimes.com

Download Image

South Boston Real Estate Market Recap: Year-to-Date Transactions Down but Prices Hold Steady – South Boston Online Feb 6, 2024rates are Louisiana (9.56 percent), Tennessee (9.55 percent), Arkansas (9.45 percent), Washington (9.38 percent), and Alabama (9.29 percent). Local sales tax. A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and

Source Image: southbostononline.com

Download Image

34 Compelling Compare and Contrast Essay Examples Birmingham also has the highest local option sales tax rate among major cities, at 6 percent, with Denver, Colorado (5.91 percent), Baton Rouge, Louisiana (5.50 percent), and St. Louis, Missouri (5.454 percent) close behind. Both Baton Rouge and New Orleans, Louisiana previously had combined rates of 10 percent, but these cities’ rates

Source Image: weareteachers.com

Download Image

Massachusetts Tax Rates & Rankings | Massachusetts Taxes Delaware, Montana, New Hampshire and Oregon rank lowest with no state or local sales taxes. Alaska comes next with a combined local and state rate of 1.61 percent, followed by Hawaii (4.38 percent), Maine (5 percent), Virginia (5 percent), Wisconsin (5.42 percent) and Wyoming (5.42 percent). The states with highest combined state–local rates

Source Image: taxfoundation.org

Download Image

12 Best Sales Tax ideas | sales tax, tax, small business tax Download free up-to-date state sales tax rates tables, or use our sales tax rate lookup by address calculator. 2024 US sales tax by state, updated frequently. … Local rate range is the combination of the base state rate and the mandatory local rate. Local rates can vary greatly within each jurisdiction and are also determined by what is being

Source Image: pinterest.com

Download Image

Study: Proposition 80 Would Give MA 2nd Highest Combined State & Federal Capital Gains Tax Rate in U.S. | Latest News The base state sales tax rate in Massachusetts is 6.25%. Local tax rates in Massachusetts range from 6.25%, making the sales tax range in Massachusetts 6.25%. Find your Massachusetts combined state and local tax rate. Massachusetts sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax

Source Image: pioneerinstitute.org

Download Image

Kellogg’s Rice Krispies Treats, Breakfast Cereal, Original, 11.6 Oz – Walmart.com The latest sales tax rate for Boston, MA. This rate includes any state, county, city, and local sales taxes. 2020 rates included for use while preparing your income tax deduction. MA Rates | Calculator | Table. Boston … Rate; Massachusetts State: 6.250%: Suffolk County: 0.000%: Boston: 0.000%: Total:

Source Image: walmart.com

Download Image

South Boston Real Estate Market Recap: Year-to-Date Transactions Down but Prices Hold Steady – South Boston Online

Kellogg’s Rice Krispies Treats, Breakfast Cereal, Original, 11.6 Oz – Walmart.com • The five states with the highest average combined state and local sales tax rates are Tennessee (9.55 percent), Louisiana (9.52 percent), Arkansas (9.51 percent), Washington (9.23 percent), and Alabama (9.22 percent). • No state rates have changed since Utah increased the state-collected share of

Massachusetts Tax Rates & Rankings | Massachusetts Taxes Study: Proposition 80 Would Give MA 2nd Highest Combined State & Federal Capital Gains Tax Rate in U.S. | Latest News Download free up-to-date state sales tax rates tables, or use our sales tax rate lookup by address calculator. 2024 US sales tax by state, updated frequently. … Local rate range is the combination of the base state rate and the mandatory local rate. Local rates can vary greatly within each jurisdiction and are also determined by what is being